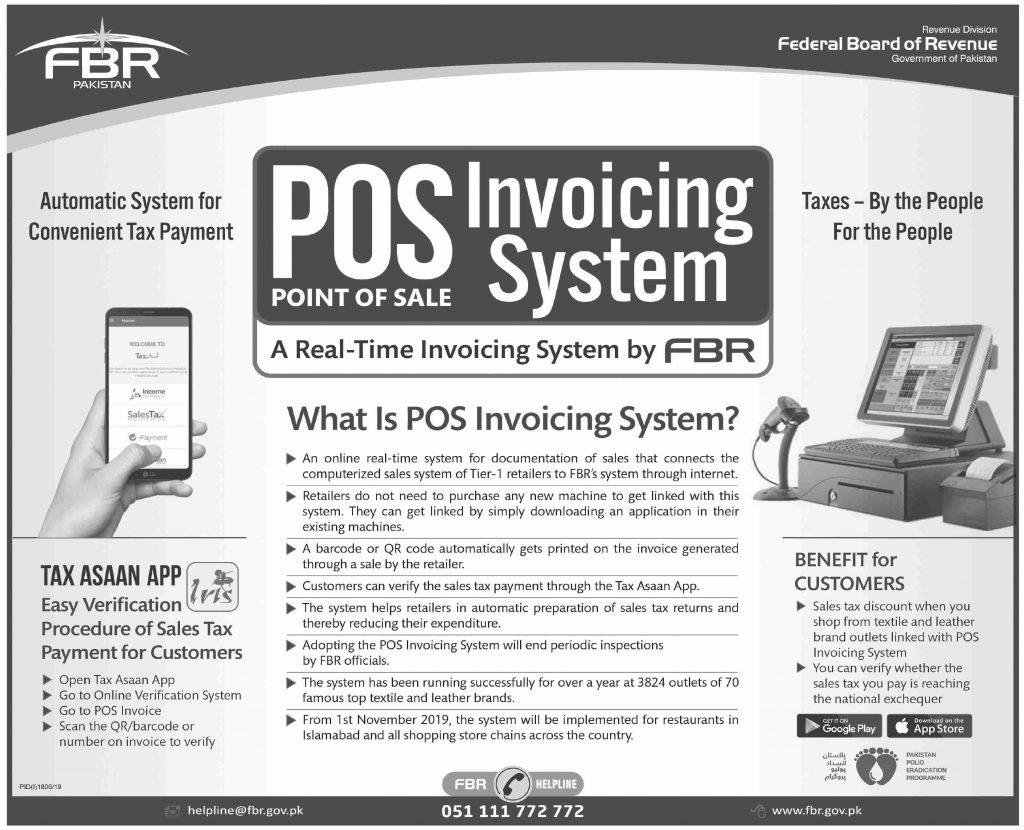

What is POS Invoicing System

♦ An online real-time system for documentation of sales that connects the computerized sales system of Tier-1 retailers to FBR’s system through internet.

♦ Retailers do not need to purchase any new machine to get linked with this system. They can get linked by simply downloading an application in their existing machines.

♦ A barcode or QR code automatically gets printed on the invoice generated through a sale by the retailer.

♦ Customers can verify the sales tax payment through the Tax Asaan App.

Read More: Pay Tax Online Through E-Payment FBR

♦ The system helps retailers in automatic preparation of sales tax returns and thereby reducing their expenditure.

♦ Adopting the POS Invoicing System will end periodic inspections by FBR officials.

♦ The system has been running successfully for over a year at 3824 outlets of 70 famous top textile and leather brands.

♦ From 1st November 2019, the system will be implemented for restaurants in Islamabad and all shopping store chains across the country.

Benefits for Customers

♦ Sales tax discount when you shop from textile and leather brand outlets linked with POS Invoicing System

♦ You can verify whether the sales tax you pay is reaching the national exchequer

Read More: Active Taxpayer Advantages & Disadvantages in Pakistan

Tax Asaan App

Easy Verification Procedure of Sales Tax Payment for Customers

♦ Open Tax Asaan App

♦ Go to Online Verification System

♦ Go to POS Invoice

♦ Scan the QR/barcode or number on invoice to verify