Every Educator of School Education Department Punjab is eagerly waiting for the pay protection supreme court decision 2021. finally, the time has come to announce about the pay protection judgement in the favour of educators (Teachers) who are appointed on initially on contract basis but at-last they were regularized into Government service and their contract service was not included. First of all, congratulate to all the educators of Punjab who are part of this decision and I hope Govt will not create further hinderance. The details of the pay protection notification is given below;

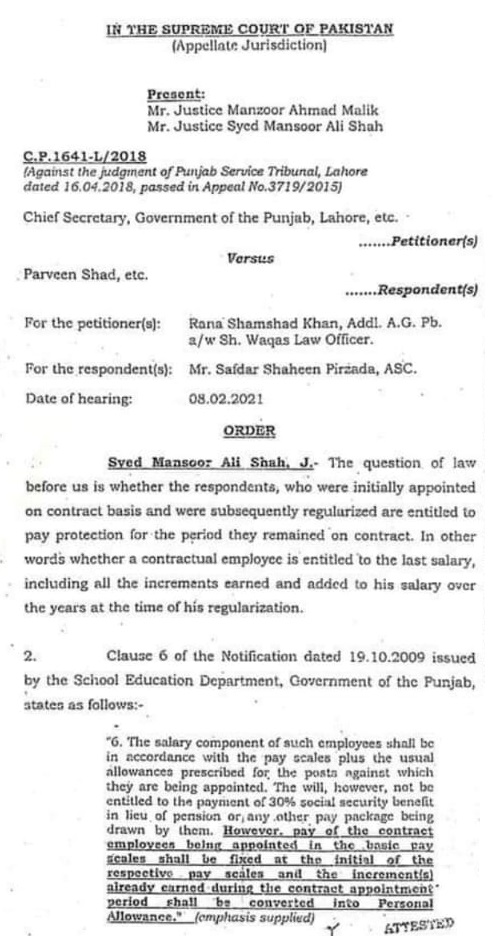

Supreme Court Decision on Pay Protection 2021

Syed Mansoor Ali Shah, J: The question of law before us is whether the respondents, who were initially appointed on contract basis and were subsequently regularized are entitled to pay protection for the period they remained on contract. In other words whether a contractual employee is entitled to the last salary, including all the increments earned and added to his salary over the years at the time of his regularization.

Clause 6 of the Notification dated 19.10.2009 issued by the School Education Department, Government of the Punjab, states as follows:

The salary component of such employees shall be in accordance with the pay scales plus the usual allowances prescribed for the posts against which they are being appointed. The will, however, not be entitled to the payment of 30% social security benefit in lieu of pension or any other pay package being drawn by them. However, pay of the contract employees bent appointed in the basic pay scales shall be fixed at the initial of the respective pay scales and the increments) already churned during the contract appointment period shall be converted into Personal Allowance.

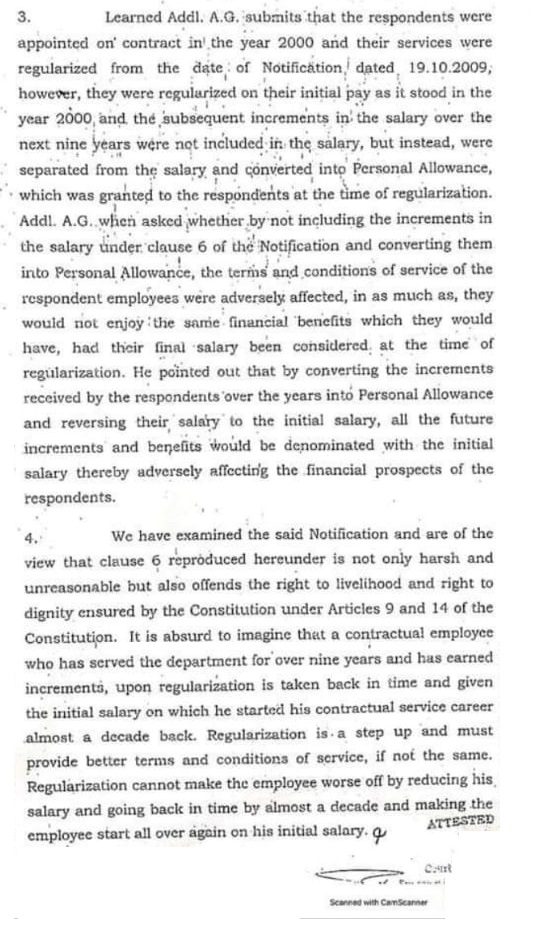

Learned Addl. A.G. submits that the respondents were appointed on contract in the year 2000 and their services were regularized from the date of Notification dated 19.10.2009, however, they were regularized on their initial pay as it stood in the year 2000, and the subsequent increments in the salary over the next nine years were not included in the salary, but instead, were separated from the salary and converted into Personal Allowance, which was granted to the respondents at the time of regularization. Addl. A.G. when asked whether by not including the increments in the salary under clause 6 of the Notification and converting them into Personal Allowance, the terms and conditions of service of the respondent employees were adversely affected, in as much as, they would not enjoy the same financial benefits which they would have had their final salary been considered at the time of regularization.

He pointed out that by converting the increments received by the respondents over the years into Personal Allowance and reversing their salary to the initial salary, all the future increments and benefits would be denominated with the initial salary thereby adversely affecting the financial prospects of the respondents.

We have examined the said Notification and are of the view that clause 6 reproduced hereunder is not only harsh and unreasonable but also offends the right to livelihood and right to dignity ensured by the Constitution under Articles 9 and 14 of the Constitution. It is absurd to imagine that a contractual employee who has served the department for over nine years and has earned increments, upon regularization is taken back in time and given the initial salary on which he started his contractual service career almost a decade back.

Regularization is a step up and must provide better terms and conditions of service, if not the same. Regularization cannot make the employee worse off by reducing his salary and going back in time by almost a decade and making the employee start all over again on his initial salary.

For the above reasons, we are in agreement with the reasoning of the impugned judgment and therefore are not inclined to interfere in the impugned judgment. Therefore, this petition is dismissed and leave refused.

good information

Is this decision Implemented till date? No

Then what is the next procedure for appeal

aoa i appoint in BPS- 11 contract bases and through proper channel apply and appoint BPS-12 also contract basis Now i am regular but department of punjab not count my BPS-11 service ,plz guide me and send relative judgement