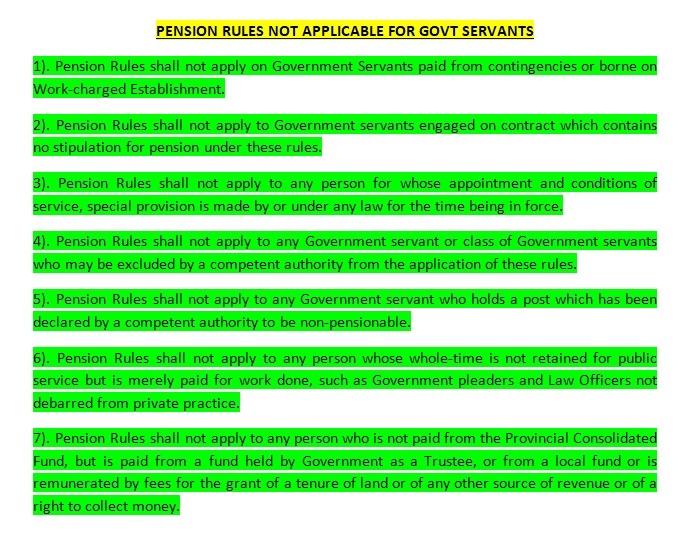

According to The Punjab Civil Services Pension Rules, the following pension rules not applicable for the Govt servants/employees.

Read More: Pension Rules for Over-Age Govt Servants

1). Pension Rules shall not apply on Government Servants paid from contingencies or borne on Work-charged Establishment.

2). Pension Rules shall not apply to Government servants engaged on contract which contains no stipulation for pension under these rules.

3). Pension Rules shall not apply to any person for whose appointment and conditions of service, special provision is made by or under any law for the time being in force.

4). Pension Rules shall not apply to any Government servant or class of Government servants who may be excluded by a competent authority from the application of these rules.

5). Pension Rules shall not apply to any Government servant who holds a post which has been declared by a competent authority to be non-pensionable.

6). Pension Rules shall not apply to any person whose whole-time is not retained for public service but is merely paid for work done, such as Government pleaders and Law Officers not debarred from private

practice.

7). Pension Rules shall not apply to any person who is not paid from the Provincial Consolidated Fund, but is paid from a fund held by Government as a Trustee, or from a local fund or is remunerated by fees for the

grant of a tenure of land or of any other source of revenue or of a right to collect money.

Read More: Early Finalization of Pension Cases

The above pension rules are not applicable for the employees working Government Department.