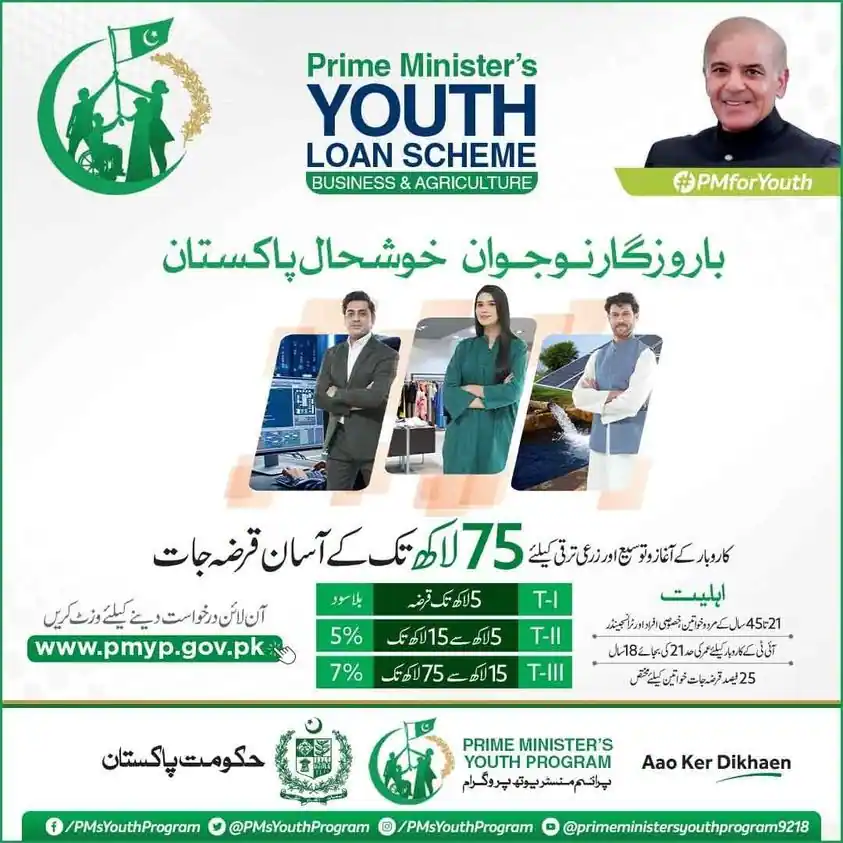

Are you ready to avail the opportunity for entrepreneurs in Pakistan. Now, you can get PM Youth Business Loan scheme 2023 with simple and easy terms. The Prime Minister of Pakistan has announced the Prime Minister Youth Business (PMYBL) Loan Scheme which have less markup. All the commercials, Islamic and SME banks will provide PM Business loan to the individual who will be eligible. There is no last date mentioned, so you can apply whenever you need to get this loan scheme. All the banks of Pakistan have same criteria as mentioned in PM Loan scheme.

You can apply for only one bank at a time for the PM Entrepreneurship program. The maximum tenure for repayment of loan is 8 years including a maximum of 1-year grace period. NTN number is not compulsory but if you have NTN number than it will increase more chances of success.

PM Business Loan Daily Update:

- PM Youth Business Loan scheme has helped entrepreneurs across the country and grow their business. There are till now, over 1.5 billion rupees in Agriculture sector loans have been distributed in agriculture industry. Apply online fast before the deadline for approval of your desired loan amount. [ New ]

Query about Loan Approval: The loan approval is the sole prerogative of the PMYP partner banks, whereas the federal government is subsidizing the whole scheme. However, banks will process according to their own procedures. It is requested that you please wait for their response.

The Government of Pakistan would distribute 30-Billion Rupees among 40,000 deserving people in Pakistan up to 30th June 2023. The PM Youth Loan registrations are opened and visit the PMYP website and start your business. You can learn how to apply for PM Business Loan for Youth of Pakistan from the official YouTube tutorials.

Prime Minister Youth Business Loan 2023 (PM Youth Training Scheme)

| Tier-1 | The range is 100,000 upto 1 million PKR with 3% markup. No Security required for loan in this tier. |

| Tier-2 | The range is above 1 Million upto 10 Million PKR with 4% markup. |

| Tier-3 | The range is above 10 Million upto 25 Million PKR with 5% markup. |

PM Business Loan Scheme 2023 Eligibility Criteria

- All the information available on Kamyab Jawan Yes Program is almost same with this loan scheme

- All men/women holding CNIC, aged between 21 and 45 years with entrepreneurial potential are eligible. For IT/ E-Commerce related businesses, the lower age limit will be 18 years.

- Small and medium enterprises (startups and existing businesses) as per definition of SBP and owned by youth as per above mentioned age brackets are also eligible.

- For IT/E-Commerce related businesses, at least matriculation or equivalent education will be required.

- This scheme is for both startups as well as existing micro and small business enterprises.

- You can always re-apply if you want to avail the increase in maximum loan size announced recently.

- No physical application is not allowed. All applications have to be submit online

- The minimum age for the applicant under this scheme is 21 years at the time of application submission. However, it is relaxable to 18 years in case of applicants applying for IT or Computer related businesses. The maximum age limit is 45 years at the time of application submission.

| How to apply for a Tier 1 Loan in Prime Minister’s Youth Business & Agriculture Loan Scheme 2023 |

- At least one business partner’s/director’s age should comply with the age limit defined under this scheme (21-45 years).

- There is no general requirement of minimum educational qualification, though it will be a favorable

consideration for decision making by banks. However, in case of businesses which compulsorily require certain qualification, certifications, diplomas, authorizations or licenses, the same must be held by the applicant. - There is no gender discrimination in this scheme and applicants of all genders are offered equal opportunities. However, considering the ground realities and to protect the fair gender, a minimum of 25% share on aggregate basis of all loans is kept for women.

- Persons employed in private jobs can also apply

- Existing micro and small enterprises can also benefit from this scheme.

- One family member cannot apply in another’s name.

- This scheme is only for resident Pakistanis

- A person cannot avail more than one loan

- Blood relatives of employees of participating banks cannot apply for loans under this scheme from the banks where their blood relatives are employed

- Government employees are strictly barred from applying under this scheme.

- All businesses which are ethical and permitted under the law are eligible for this scheme.

- Applicants are advised to select businesses which are ethical, legal, commercially viable, and suitable for applicants’ respective areas and for which applicants possess required minimum knowledge, experience, training and support

Also Check:

Installments/Repayment of PM Business Loan 2023

- Loan can be repaid in equal monthly, quarterly, bi-annually or annually installments. However, the exact repayment terms would depend upon the specific business types and banks’ decision. The applicant is encouraged to negotiate these terms at the time of finalization of loan with the bank.

- Scheme allows a maximum of 1-year grace period. However, the exact grace period would depend upon the specific business types and banks’ decision. The applicant is encouraged to negotiate these terms at the time of finalization of loan with the bank.

- Applicants can make early repayments during the loan tenor which would reduce the principal portion of their liability.

- There is no limit on the number of balloon payments.

- A borrower can make balloon payments only if the loan is regular, that is there are no overdue installments.

- An applicant making balloon payment has the option to reduce the loan repayment period, or have the installment reduced or opt for a combination of both of these options.

- An applicant can repay the loan in full any time before the loan maturity date.

List of Banks For PM Youth Business Loan Program 2023

Following banks are participating in this scheme:

- Allied Bank Limited

- Albaraka Bank Limited

- Askari Bank Limited

- Bank Al Falah

- Bank Al Habib

- Bank Islamic Pakistan Limited

- Bank of Khyber

- Bank of Punjab

- Dubai Islamic Bank Limited

- Faysal Bank Limited

- First Woman Bank Limited

- Habib Bank Limited

- Habib Metropolitan Bank Limited

- JS Bank Limited

- MCB Bank Limited

- Meezan Bank Limited

- MCB Islamic Bank Limited

- National Bank of Pakistan

- Sindh Bank Limited

- Soneri Bank Limited

- United Bank Limited

Also Check:

How To Apply For PM Youth Business Loan 2023

You need to fill the PM Youth Business Loan Application form that link is given below;

- You must have scanned copies / clear visible pictures of following documents ready before you start your application:

- Passport Size Picture

- CNIC – Front Side and CNIC – Back Side

- Latest Educational degree / certificate, if and whichever applicable: Matric, Intermediate, Bachelors, Masters, PHD etc.

Apply For Tier-1 Loan in PM Youth Business Loan Scheme 2023

- At least one business;

- Experience certificate(s), if applicable

- License / Registration with Chamber or Trade Body, if applicable

- Recommendation Letter from respective chamber / trade body or Union, this is mandatory in case of existing business.

- You must have the following information handy before you start your application:

- National Tax Number, in case you don’t have one please register at https://fbr.gov.pk/categ/register-income-tax/51147/30846/71148 https://fbr.gov.pk/categ/register-income-tax/51147/30846/71148

- Consumer ID of Electricity bill of your current address. (NITB to link image of where consumer ID is written on electricity bill)

- Consumer ID of Electricity bill of your current office address, if applicable.

Apply For Tier-2 & 3 in PM Youth Business Loan Scheme 2023

- Complete Registration number of any vehicle registered in your name, if applicable.

- Name, CNIC and Mobile numbers of Two References other than Blood relatives.

- An estimate of Monthly business income, business expenses, household expenses and other income should be available with you in case of new business while in case of existing business please provide actual Monthly business income, business expenses, household expenses and other income, if any details.

- Please Note:

- Please sign up to submit application.

- You must have a mobile number registered in your name to start this application on which Bank shall communicate with you.

- This application shall take at least 15 minutes to complete subject to availability of above listed information.

- You may complete the form in one go or save a draft for submission later on.

- Please upload as much information as you have e.g. Financial Statements, Business Feasibility, Last 6 months Bank statement, etc. This shall help to better evaluate your application.

- Once the form is submitted, your application registration number shall appear on the screen and you will also receive SMS stating the same, please keep it safe.

- You will receive SMS once your application moves to next stage of process, however you may check your submitted application status on this web site as well.

| Official Website | Application Online |

| Latest Employees News | Home Page |

I Need a Loan For Using a Livestock

Mujhe business loan chaiey

Asslam o alikum I need loan for stock lot of socks plz send me ur answer

Hi im habib im from karachi i want to apply pm youth program loan

Muje busines k liye

I need youth loan

My name is Ali Ahmed I’m student and I need pm loan plz

My name is Ali Ahmed I’m student and I need pm loan plz

For develop my bessiness

Loan wanted

Nice program.iam interested this program plz give me a loan details.i give a loan

Mujeres chahiye

application from required not show

I need this loan urgent,plzzz.

Muj ko businesses Kay Liya loan chai please

Muhammad Shehbaz Sharif Sir, mujhay loan ki zroorut hai education kay liyay,500000.

Please pm of Pakistan I need help from yoth sceem its very amportet for young youth

I m keenly interested for this loan

My name is Adil Malik and I need pm loan plz

Hello Sir! I want business loan i from Gujranwala!

My name is Adil ma karobar karna ha

For business

which bank is dealing this more efficiently

Middle class loan ha

How i can apply

Assalam o Alaikum

I have alot of many try for downloading form bit I can’t download form because error is show on display so please tell me procedger form downloading.

PM said its a free from the interest why he pass his fake statement to make people fool.

How to apply for loan

500000 tk lone chaya

This is a good program and I hope continue this program properly and Carefully successed

I wanted youth loan

ID card pe aa kr problem ho rahi thi is application mein..ni fill ho saki.

Mein apna businesses strat krna chahta tha..jo ni ab ni ho sake ga..Q.k application hi ni ho rahi

Sir,

My name is Mohammed Bilal Ahmed Sir Mujhe loan chahie agriculture business ke liye.

My neame is Muhammad SHABAN from Rahim yar KHAN Maine ny laon apply kia hy ye kb tk mil jay ga is bary Maine confirm kr daine plz

Hello my name is afaq ali very good scheme is Punjab

My current age is 45 years and 5 months can I apply for this scheme

I need a Loan from P.M Loan Scheme for develop my small Business.

One million required

Need loan to sustain and improve my vehicle restoration business

kia first tier ma HABIB METRO bank add nai hai mean agar mara account iss bank ma hai to ma loan nai la sakta

Anyone can tell me that how much interest rate is applicable on this loan?

Dear Sir,

Iam Abdul jabbar from Gulberg lahore jobless from the last two year plz allow me a grant of loan from pm youth loan scheme

Mujy both zarort ha pllzz mara koi karo bar ni ha

Sir muja loan chiya ma business krna chata Hun

Is this loan available in Karachi also

I need to loan

i will start my own business it related

Hi my name is sumaira and I’m working in Saudi Arabia I need loan to fulfill my needs

Mera PMYP Laon approval ho gaya hai par mujhy loan nahi mila sub documents pory ho gaey security k charge’s bhi ly leye akhowat waly kehty meezan bank waly nahi dy rahy pesy

I need urgent 15 lac rupees loan

My name is RiazAhmed I am livestock former give me PM loan Plz

apply for loan

I have filled form of business loan ,I have mistake in form, I would like edit

Government should allow every employee work for freelancing

In the Japan every employee gives on hour to government for development country

We need work just like as a team, if any one employee take responsibility as a nation,

If all member of nation working for freelancing, we will be developed country,

Government should allow this policy for development country

Government should bring training institute every city, we are fourth number,

As a nation we all member of one state ,that’s all

Sir shop k lye loan chahye

Mujjy loan Chay ma milk yogurt ki shop banana chata ho

I am a new busines

Age limit for housing loan

this is a great opportunity specially for students to earn some profits and overcome their study informations

Mujy bisnis KY lie 5 lack ka karza zarotat hy

i Want to apply PM loan for business , I want to start business for my career . Pleased some one guide me how to get this loan opportunity .

My contact number is 0320-7031180

Respected ones ! i’ve applied for loan before a month almost but after nadra verification message no furyher process is being done۔kindly pay attention on my application because i’m dire in need of it & waiting for your further procedure۔thanks

I applied for business loan so week ago I and Bank not contet me

Boss I fill the form but no respond

Sir m bhot greeb hn Meri 5 bhena Hain unki shdi krni ha koi kamna Wal NH ha Abu ki death ho gi ha Ami ki tabity khrab rekhti ha please apko Ramzan Mubarak ki mehna sdk zaqat ya Jo b Pisa Hain mujhe ahal krdo Mera id card aply krw do 3610451119461 ya number ha please approve kdo apki mahrbhani ha bhot

I also neend loan plzzz

I am M Subtan Ali I am apply this business loan but I received no sms no email I really need this loan please contact me our beloved PM my number is 03091771921

I will start my self Business. I will thankfull to you for this kindness

I am 62 years old , healthy and agile I also want to contribute towards the nation economy along with my earnings.

I am a retired person has a vast experience in animal sciences, belong to rural setup, did my Bsc hons in Animal Husbandry in 1983, I have an elder son who is BCOM and doing a private job in sialkot. I have a very small piece of agri land near sialkot Airport.

I can mortgage the land in favour of any bank who is inclined to support us financially to establish a small heifer farm/livestock farm. We will raise the animals and sell them in the market to improve our financial health as well as contributing towards the nation economy uplifting.

Thanks waiting for an early response.

Sir mjy 40 lakh rupey chahiye han business k liye 1 lakh pr qist dun ga inshallah ho sakta ha kya District Mansehra U/C schan Kalan Keri sirhan

Aslam u alaikum ineed pm youthloan scheem

I just want to know that the applications are still submitting or the date is expire. AS i have visited the site to apply for loan and the form is taking information that’s why i am confused whether the process still going on and can i still been able to apply for a loan, on the other hand i had visted the date 30th june is the last date.

Humble request to clarify asap.

Thanking you

Saeed Ali

I am a woman.i need this loan for business

this is fake loan koi bh ni mill reha